As a freelancer, you know what it’s like to do your business administration on your own. Logging hours, tracking mileage, and staying in touch with clients are all your responsibilities.

But those hours spent doing admin are a resource drain – they’re hours you could be spending on client outreach, follow-ups, and billable tasks. Here, we introduce you the best independent contractor apps for streamlining your admin and accounting tasks.

Whether you own an Android or iOS device, there are plenty of apps that can make your life easier. They’ll save you time, and even a little money when tax season rolls around.

So, what are the best independent contractor apps out there?

And what makes these apps so useful for your business?

In this post, we’ll get a good look at the best of the best:

1. Tax Apps for Independent Contractors

2. Payment Apps for Freelancers

3. Apps for Tracking Mileage

4. Time-Tracking Apps for Solopreneurs

5. CRM Apps for Freelancers

Best Tax Apps for Independent Contractors

When you’re a self-employed professional, taxes can get a little complicated.

Since the government isn’t taking taxes out of your paychecks, it’s up to you to figure out how much you owe at tax time. That means you need to keep track of your income throughout the year.

Luckily, you can get help from these accounting apps:

Intuit Quickbooks Self-Employed

From one of the biggest names in taxes comes Quickbooks Self-Employed, every freelancer’s dream. This app is exactly what you’re looking for when it comes to keeping all of your business expenses in one place.

The most notable feature is the ability to photograph and upload your own business receipts.

Once uploaded, you can categorize your expenses. You can differentiate between personal and business spending as well as the type of spending (i.e., meals, travel, supplies, etc.).

Better yet, you can use the program to create invoices.

Personalize the appearance of your invoices to match your brand and keep track of how much money you’re sending out and bringing in.

Quickbooks keeps everything you need in one easy-to-use platform!

When it’s finally time to do your taxes, you can easily transfer your Quickbooks data to TurboTax and simplify the whole tax filing process.

Freshbooks app

Though not as popular as Quickbooks, Freshbooks is a very similar platform. The entire purpose of Freshbooks is to make tracking your income and expenses a breeze.

Most notable are the app’s client contact features.

Instead of having to email, call, or text a client individually, you can contact them directly through the app. So, no more switching between tasks and losing your train of thought.

With Freshbooks, you can send out and approve invoices with ease. You can accept credit card payments and bank transfers as well.

To top it all off, it helps with expense tracking, too.

All you have to do is snap a quick photo of your receipt and it’s automatically logged in the system. You can also keep track of your billable hours through the app for more accurate invoices.

Related: How to Stay Organized as an Independent Business Owner

Best Payment Apps as a Freelancer and Independent Contractor

Being a freelancer means giving up those oh-so-convenient direct deposits that you used to get as an employee in your traditional jobs.

Now, you have to send out invoices to make sure that you get paid. Yet, you want to do so in a way that’s highly secure and allows you to track your income during the year.

Fortunately, there are a few awesome apps that will help you simplify this process:

PayPal

PayPal is one of the most popular money transfer apps out there, and for good reason. It allows you to send and receive money in mere seconds, so you can conduct transactions in real time.

PayPal is great for keeping track of how much you’re bringing in and how much you’re spending. You can use it to purchase business supplies and materials, but also to invoice clients.

It’s incredibly convenient, as you can link it directly to your bank account, credit card, or debit card. Just draft up the invoice within the app and send it to your client. The money will appear in your account as soon as the client sends it!

But, what’s most important are the security features.

You can enable fingerprint ID to log into your account and exchange money — which comes in handy if your phone is ever lost or stolen.

The last thing you want is a stranger having access to your finances. Read how PayPal’s fees compare to these 5 Venmo Alternatives.

Stripe

Stripe is the tool every self-employed professional needs to keep track of their spending and income.

What makes Stripe unique is that you can easily visualize your business’s success via the dashboard. You can see how much cash you’ve brought in, how many payments you’ve made, and even how many customers you’ve had.

If you’re a data person, you’ll love the trend graphs.

Stripe is great because you have immediate access to your expenses and your income. The app will neatly organize what you’ve spent and who your income is coming from.

The app will even send you notifications to update you on your finances. Tracking your company’s growth is easy when you can see your daily revenue at all times!

Better yet, you can issue refunds to your clients if need be. This app was truly built for any situation.

Best Apps for Tracking Mileage as a Small Business

![]()

When tax season rolls around, you want to be able to take advantage of as many deductions as possible.

Did you know that each mile you traveled for work in 2019 was valued at about $0.58?

The more you travel and keep track of your mileage, the more money you can get back on your refund. But in order to deduct the standard mileage rate, you’ll have to track how far you drive.

If that sounds complicated, use one of these apps to help you:

MileIQ

MileIQ is undoubtedly the best mile-tracking app for self-employed drivers, folks and small business owners. You don’t have to do much other than swipe!

The app will use your phone’s GPS to record your movements during the day. It’ll detect when you’re driving and take note of how far you’ve traveled.

As the user, all you have to do is swipe left for personal travel and swipe right for business travel. No longer do you have to save all of your paper receipts to bring to your accountant at the end of the year.

What’s even better is that you can visualize your tax deductions with every trip you complete. The app considers the IRS’s standard mileage rate and calculates your deductions as you add more miles to your account.

The app develops monthly reports, too, which is helpful when budgeting for gas and insurance.

Everlance

Everlance does just about everything a self-employed person like yourself would need, but we want to hone in on the mileage-tracking feature.

Just like MileIQ, the app runs in the background of your phone and records how far you’ve driven throughout the day. Swipe left for personal trips and swipe right for business. Keep track of your deductions with each and every ride.

But, this app does have a few extra features.

Most important is the ability to create travel logs. This allows you to keep track of where you traveled to and when.

To make sure that all of your data is readily available when April arrives, all of your mileage data is saved on the cloud.

So, even if you get a new phone or your app crashes, you’ll have exactly what you need when you need it.

Is Acuity right for your business? Learn more in our Acuity Scheduling Review for Freelancers and Contractors

Best Time-Tracking Apps for Gig Workers

Some freelancers charge by the project, which makes invoicing a whole lot easier.

If you charge by the hour, however, you’ll want to make sure to charge your clients for every minute that goes into a project. This can be a little tricky if you don’t work set hours every day.

But, there are time-tracking apps to help you.

Here are a few of the best time-tracking apps on the market:

HoursTracker

HoursTracker takes into consideration just about every situation you might find yourself in. Plus, it’s incredibly easy to use.

You can set an hourly rate and then easily clock in or out with a simple click of a button. This allows you to keep track of your hours worked during the week and how much money you brought in during the day.

You can also manually log your hours, too.

But, the key feature is the GPS technology.

If you have an office outside of your home, you can identify the location through the app. HoursTracker will notify you every time you arrive or leave the office to remind you to clock in and clock out.

Then, you can use your logged hours to create an invoice directly in the app. HoursTracker even lets you add extra expenses, so you can account for mileage, tips, and anything else you might need to include in your invoice.

ATTO Timesheets

The ATTO Timesheets app is as simple as it gets when it comes to tracking your hours worked.

Just like HoursTracker, you can set a designated workplace or manually add your own hours. Clock in and out with a simple tap of an on-screen button.

Yet, there are plenty of other features.

If you have other employees, this is a great way to keep track of the hours your workers are putting in and where they are when they’re on the clock. This is amazing for maintaining an accurate timesheet.

The app also allows you to generate job codes to see just how much time your employees (or even just you) are spending on each task. You can even pause your hours when you take breaks.

This is probably one of the best apps for recording your billable hours.

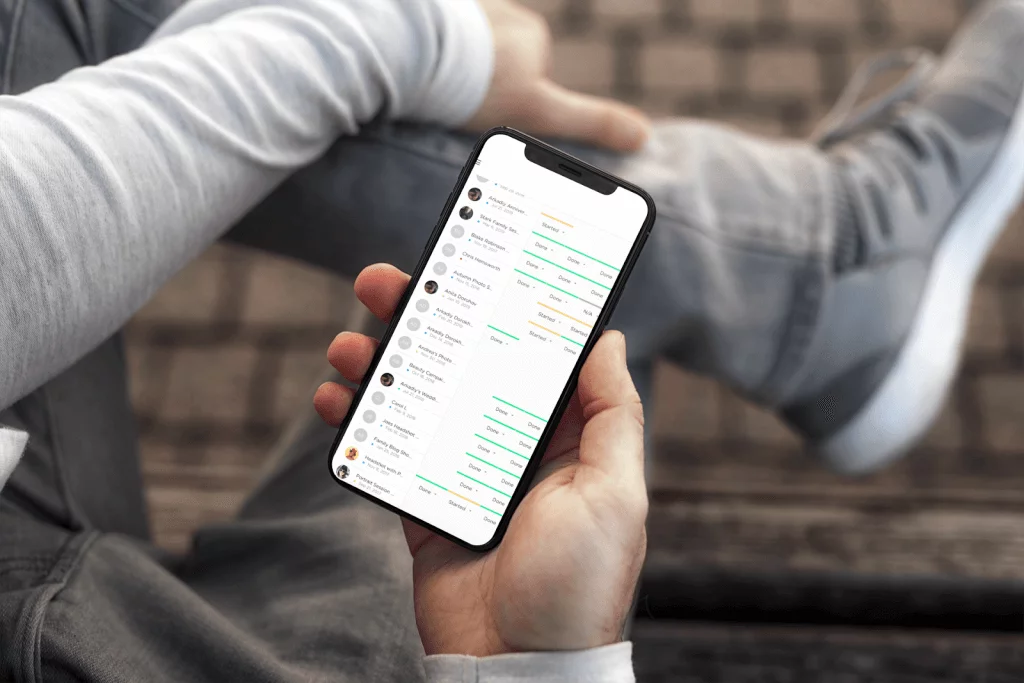

Best CRM Apps for Freelancers

A customer relationship management (CRM) app is a necessity for any business. These programs allow you to organize and manage all of your projects and client interactions.

These days, CRMs have a lot of added features, too.

The best CRMs out there also allow you to track your expenses and send invoices directly through the app. This limits the need to have ten different apps clogging up your phone.

Here are some recommendations:

Bloom

Bloom is one of the best CRMs for self-employed professionals. It was originally designed for freelance photographers, but it’s a great tool for solopreneurs in any field.

That’s because you can do just about anything with Bloom!

You can track your leads and even contact your customers or potential clients right through the program. Bloom even gives you the ability to schedule client meetings with nothing more than a simple click of a button.

Setting up an automated email campaign has never been easier. Bloom helps you nurture your leads and stay in touch with existing clients.

It also allows you to manage your workflows and keep track of all relevant data related to clients. One of the most important features is that you’re able to send and receive important documents that need to be signed.

When your project is finally complete, you can send out an invoice to be paid. No need for a separate invoicing app!

Try Bloom for FREE today!

Drift Meetings

If scheduling appointments or client meetings is your top priority, Drift Meetings is the tool you need.

With this program, you can easily send a link to your Drift page via email or social media. From there, your clients can schedule a meeting that fits into both of your schedules.

What’s even better is that the app prequalifies your clients. Before scheduling the meeting, your client will fill out a form about their business needs and budget. By the time the meeting comes, you know exactly what to expect.

You can engage with clients directly through the app’s chat feature. And when you’re not available, a chatbot will take your place!

Drift Meetings takes a lot of the back-and-forth out of the scheduling process and makes everyone’s experience much less stressful.

How does Calendly compare to other scheduling tools? Find out in our 5 best Calendly alternatives review.

Conclusion

Why make your life harder when there are so many great tools out there? If you’re self-employed, these apps can optimize your business!

So, make it a point to download some of these smartphone apps. Whether you want help with bookkeeping, taxes, tracking mileage, or communicating with clients, these programs will help.

Both you and your customers will be better off for it!

Try Bloom now for 14 days — free!

Independent Contractor Apps FAQs

What is a good app for 1099 employees?

A good app for 1099 employees, often referred to as independent contractors, is an independent contractor app tailored to the needs of gig workers. Apps like Uber for drivers or food delivery platforms like DoorDash cater to specific industries, but for a more general focus on earning, apps like QuickBooks Self-Employed can help contractors write, plan, and manage their financials. It provides tools for businesses to pay employees, handle payroll, and file accounting details each month.

Is there an app for self-employed people?

Yes, several independent contractor apps cater to the self-employed and small businesses. QuickBooks Self-Employed and FreshBooks are examples, offering accounting software solutions tailored for the gig economy. These apps are especially useful for independent contractors across various industries, from delivery drivers to custom work professionals. They allow contractors to track earnings from multiple gigs, pay for expenses, and even plan for taxes.

What is the best way to keep track of 1099 income?

The best way to keep track of 1099 income for independent contractors is through specialized independent contractor apps. These apps, often linked with accounting software, allow gig workers to focus on their earnings from diverse gigs, whether that’s food delivery, car services like Uber, or other freelance jobs. By using these apps, contractors can write down their monthly income, plan for expenses, and ensure they’re prepared for tax season.