As an independent contractor, you know that keeping track of your business expenses is both time-consuming and completely necessary. It helps you to track your income and tax write-offs to make your life a bit easier come April 15.

Yet, manual records are often outdated and hard to navigate.

Plus, you should be able to access your business expenses and possible tax deductions whenever it’s convenient for you.

But here’s the good news:

Keeping track of your business expenses in 2020 is easier than ever!

That’s because most of your expenses can be tracked digitally or through smartphone apps that can help to keep you organized year-round.

In this article, we’ll discuss how to track business expenses using mobile apps.

More specifically, we’re going to talk about:

1. Opening a Business Bank Account

2. Using a Business Credit Card

3. Tracking Your Business Mileage & Travels

4. Keeping/Recording All Business Receipts & Expenses

5. Signing Up for a CRM

1. Open a Business Bank Account

When you’re a self-employed person or small business owner, it’s your responsibility to track your cash flow. That’s because you’re not getting a weekly or biweekly paycheck with your taxes taken out. In essence, you’re your own bookkeeper.

Opening a separate business bank account can make your life a whole lot easier.

You won’t have to worry about the commingling of your personal and business funds, and tax season is no longer your worst enemy. Come tax time, all of your income and expense records will be in one place.

No more endless hours of math trying to decipher between business and personal spending!

How to Open a Separate Business Bank Account

There’s not too much of a difference between business and personal bank accounts. You can store and access your own funds in both of them. However, business accounts tend to have slightly higher monthly fees.

So, what do you need to open a business bank account?

The most important documents include your Social Security card and a valid driver’s license. You don’t need to have a separate business entity, but, if you have an LLC, you’ll also need documentation to prove that (i.e., a business license).

Keep in mind that there are fees associated with having a business account. Make it a point to factor your monthly fees into your budget. They’re usually about $20 or less per month.

If there is a minimum account balance, make sure you’re able to meet it consistently.

Banks vs. Credit Unions

Most people automatically head to the local bank to open a business bank account.

But, there might be a better option: credit unions.

What makes credit unions so unique are the strict membership requirements. They don’t just hand out accounts to anybody that applies.

Unlike banks, credit unions are not-for-profit organizations. That means they can offer incredible customer service without pressuring you into making a financial decision that benefits them.

They also tend to limit the fees associated with having an account, and the interest rates are hard to beat. Interest rates are high on deposits and generally low on loans.

Getting a loan tends to be much easier with a credit union, too.

Though credit unions offer great opportunities, you need to do what’s best for your own business and career.

So, do your research first.

2. Use a Business Credit Card

If you’re in a field where you have to spend a little money to make a lot of money, having a business credit card is your best bet. That’s especially the case if there are possible deductions that you can claim on your taxes.

For example, you might be eligible for the following tax credits and deductions:

- Expenses related to your home office

- Subscriptions for industry-related media (i.e., magazines or newspapers)

- Marketing and advertisements costs

- Travel costs

The best aspect of business credit cards is that they keep all of your expenses in one place. You can prove what you spent your money on and how much you spent, without having to keep your paper receipts!

You can even link the card to your business bank account and make paying your bills even easier.

The Benefits of a Business Credit Card

Just like personal credit cards, no two business credit cards are the same. So, you’ll want to do some comparison research before applying for a card.

Consider your business needs first.

If you spend a lot of money to keep your business going, choose a card that has a higher credit limit. Some cards actually offer a credit limit of well over $50,000.

Plenty of business credit cards also offer incentives and rewards.

So, if you travel a lot for work, you might want to get a card that allows you to earn airline miles every time you spend. If you’d prefer to get some money back instead of airline points, find a card with a cashback program instead.

Spending Carefully

A business credit card is convenient, but there’s always the chance you might accidentally use it for personal needs. This can lead, at the very least, to major headaches but usually to worse negative effects to your finances, so you need to fix the situation as soon as you catch it.

Since you’re self-employed, it’s easier than other business scenarios to commingle personal and business expenses. If you catch yourself putting a personal purchase on a business card, make sure you reimburse the money into the proper account as soon as you realize your mistake.

Take note of this error as well. The last thing you want is an IRS auditor questioning your financial statements.

So, how do you avoid this mistake?

In all honesty, you don’t need your business credit card everywhere you go. You can pack it in another bag or wallet and only bring it with you when you plan to use it for business expenses.

Sites like Amazon do everything they can to make the check out process as easy as possible. If you’re using your business card to buy business supplies online, be sure to double-check the card you’re using before approving the purchase.

Better yet, don’t save your credit card information to any online accounts. Manually enter it every time you buy something!

Related: How to Stay Organized as an Independent Business Owner

3. Track Your Business Mileage & Travel

As a self-employed individual, you want to be able to take advantage of as many tax deductions as possible. That’s more money in your pocket at the end of the year!

Whether your job requires you to travel across town or across the country, make sure that you’re keeping track of the miles you travel. Your travel expenses can be written off in your annual taxes.

In 2019, business miles were valued at about $0.58 per mile. If you’re putting in thousands (or even hundreds) of miles for business travel, it begins to add up.

And now, tracking those miles is easier than ever.

There are plenty of mileage-tracking apps you can download on your smartphone right now that make logging your work miles a mindless task.

The Best Mileage-Tracking Apps

MileIQ is one of the most popular mileage-tracking apps.

What makes this app so great is that you don’t have to manually turn it on or off. It automatically keeps track of your travels through your phone’s GPS, and it’s up to you to sort it as either a personal or business trip.

So, how do you do that?

Easy!

Just swipe left if it was a personal drive, and swipe right if it was for business.

What’s really cool is that you can also keep track of your possible tax deductions as you add miles to your tally. No need to add them up at the end of the year because you’ll know exactly how much you can deduct.

4. Record All Business Receipts & Expenses

In 2020, expense tracking is a paper-free process. You no longer need to stockpile all of your receipts in a shoebox to deal with at the end of the year. You don’t even have to make your own Excel spreadsheet or write down your expenses in a physical book.

However, you do still need to keep track of your expenses in some way.

Using Business Expense Apps

There are plenty of business expense apps out there, but not all offer the same features. Some are much better for self-employed folks like you.

One of the best apps is Quickbooks Self-Employed.

All you have to do is take a photo of each business receipts and upload them to the app. It’ll store your expense data for you to access later on.

You’ll be able to sort your receipts into personal or business folders and also categorize your spending. For example, you can create different folders for supplies, meals, and other expense categories.

The app then makes you a personalized expense report that you can use when filing your taxes.

You can see at all times where your money is going and stick within your own personal business budget.

Avoiding Pile-Ups

In such a fast-paced world, it’s easy to get in the mindset of, “I’ll do that later.”

If you can actually remember to do the things you say you will, that’s great. But if you’re like the rest of the world, you’ll probably forget about them an hour later.

When it comes to recording your business expenses, you want to log them as soon as possible. And since these apps are so convenient and user-friendly, there’s practically no reason not to.

Take a picture of the receipt as soon as you get it.

As soon as you get into the car (or even before that receipt makes its way into your pocket), snap a photo of it.

The last thing you want is a pile-up of receipts that you have to sift through a day, week, or month later.

Run a better business: 10 Essential Skills That all Freelancers Need to Master

5. Sign Up for a CRM

So, you’ve got the financial data down.

But what about the minor details, like your invoices?

If you’ve taken steps to simplify the process of tracking expenses, don’t you want to do that for your invoicing process, too?

This is where a CRM system will be your best friend.

You do have to pay a monthly fee, but it’s worth it if you choose the right CRM.

The Basics of a CRM

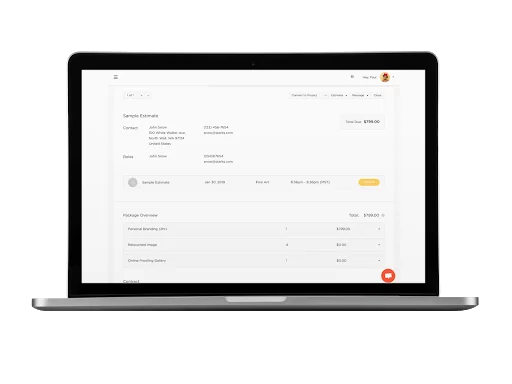

Let’s talk about Bloom.

Bloom is an excellent tool for keeping all of your client interactions in one organized location. You can use the program to schedule meetings with clients and to send and receive important documents.

But, there’s so much more to it than that.

In addition to its other features, Bloom allows you to communicate with your clients through the tool itself. You can keep track of who you spoke to, when you spoke to them, and what you talked about.

You can also develop email campaigns, which will help you maintain a consistent client base.

All data related to the inner-workings of your business are stored in this one useful tool.

Sign up to try Bloom for 14 days — free!

Tracking Finances With Bloom

Bloom’s ability to record and organize your financial data is practically unmatched.

It allows you to keep a close eye on your workflows, your bookings, and your leads. You can use this data to figure out whether your current strategies are working and how much money you’re actually making.

What really sets Bloom apart is that you can send invoices to your clients right through the program.

That means you have data on which packages and add-ons clients chose and when you were paid.

What you do with this data is up to you. But, it can help you to drive sales and boost your profits.

By analyzing your current business finances and looking at where the majority of your income is coming from, you can refocus your efforts and improve your business strategy.

Conclusion

For sole proprietors, it’s never been so easy to track expenses. It takes a little bit of work at first, but staying on top of your finances will simplify your life in many ways.

You’ll no longer have to spend hours subtracting your business expenses from your personal expenses, estimating how many miles you’ve traveled for work, or sifting through receipts to figure out what you really spent.

Open a business bank account and get a credit card solely for work. Keep track of your business mileage and log your work receipts in an app. Then, sign-up for a quality CRM like Bloom to make client communication and financial tracking even simpler.

Even if bookkeeping isn’t your strong suit, you can run your business like a financial wizard!

Don’t forget to sign up for Bloom’s free 14 day trial!