Your business is important. The service you provide fills a need for others, and you should be able to charge and get paid for your work. It’s a simple economic process.

But sometimes other factors intrude, creating obstacles to the basic ebb and flow business model. Clients can go through rough financial patches, downward burnouts, seasonality, or industry slumps.

Some obstacles might seem beyond your clients’ control. There may be a global economic crisis, a pandemic like COVID-19, or a natural disaster. You’re aware of the obstacle, but you provide the service anyway. Then it comes time to submit an invoice.

You could just go through the motions, knowing deep down you probably won’t get paid. The extra time spent is more money lost.

Or, you could be proactive and tweak your invoicing process. A few adjustments before you bill might be all it takes to get paid even when the client’s revenue is down.

Being prepared to handle obstacles before they become an issue is key to protecting your income.

We’ll cover these steps in learning how to write an invoice:

1. Communicating With Your Customers

2. Clarifying Your Expectations

3. Writing Clear Invoices

4. Developing a Follow-Up Plan

5. Adjusting Your Payment Policy

6. Streamlining Your Payment Process

7. Investing in CRM Software

8. The Anatomy of a Polite but Firm Invoice

9. How You’ll Get Paid

1. Communicate Before the Invoice Is Sent

Think about the steps you go through during any transaction in which payment is reserved until after services. Doctor visits that are billed to your insurance require you to sign paperwork first. If you hire an attorney to complete research for you, they’ll have you sign a contract before they begin work. You don’t balk at these typical requests because they are expected when you receive a professional service.

You are also providing a professional service, so why not have a contract in place with payment terms signed by the client ahead of time?

Your contract doesn’t have to be full of legalese or be unnecessarily verbose. A simple paragraph, checked by a paralegal to verify its credibility, is all you need. Make it a standard part of your hiring procedures to start work only after the contract is signed.

Most of us are so used to having to sign paperwork before hiring someone that it’s sometimes stranger not to do it than to have a formal contract.

Take some time to come up with a short, succinct explanation of your contract. If you don’t make it a big deal, clients won’t see it as one, either.

Once you have the contract signed, return a completed copy to the client and store the original in a secure place. For most transactions, you won’t need to reference it again. But if you do, it’s better to have it easily on hand.

In all your communications, be friendly and professional. When your invoice comes across your client’s desk, they’ll remember how you treated them.

As a general rule, people are more likely to make a timely payment to someone who’s personable than they would to a nondescript or rude creditor.

2. Be Clear and Remain Consistent With Your Expectations

As a freelancer or business owner, it’s important to have set expectations in place for transactions and payment terms. Your clients should know when they’ll be invoiced, when the payment is due, and what happens if they don’t pay.

In any successful business, you’ll have two types of clients: one-offs and long-terms. For your ongoing clients, regular invoicing processes are crucial for them and you.

Customers don’t want to sit around and wonder when they’ll be billed for your services. Most likely, they have a budget and a routine set for when they pay their bills. If they know your due date is always on a particular day, it’s easier for them to manage their funds.

When revenue is down, this ability to predict what needs to be paid is everything. If you’re not on the list ahead of time, your invoice may not make the cut.

However, if your clients are mostly one-offs, let them know that payment is due at the time of receipt of service. Some third-party sources let you secure your payment ahead of time, only released on approval from the client.

As part of your general expectations, it’s up to you to include all relevant information clearly, including payment options. Miscommunication can lead to hard feelings or skipped payments. If you only take PayPal and they only pay by credit card, it’s good to know ahead of time.

3. Write Your Invoice Clearly

One of the very first things you should have in place as a business owner is an invoicing system. There are thousands of invoice templates and programs that offer this service.

Once you have a template, you won’t have to continually type and format your business name header. It will auto-populate an invoice number and alternate contact information. In addition to communicating through your CRM messaging system, be sure to provide them with your phone number as well as email and mailing addresses.

Take some time to investigate the pros and cons of various invoicing software and/or free invoice templates before you decide which one is for you.

If you use the same descriptions repetitively, you can save time by plugging in pre-populated texts. An invoicing program that lets you generate and insert auto-filled text on demand would be helpful.

For your convenience, be sure to itemize each line with a description of services. If anything is ambiguous, it’s normal for it to be questioned before it gets paid. It’s up to you to make sure line items are clearly detailed so the client can’t use the questioning technique to delay payment.

In addition to the total amount, show the subtotal and then added sales tax so the client understands the final figure. The total amount due should be bolded, highlighted, or otherwise prominent on a separate line to ensure visibility and eliminate confusion.

Your itemized description is the part of the invoice that varies per client. In the default section, clearly state your payment terms. Include payment details, such as methods of payment that you accept like PayPal or checks (include the company name that appears on your bank account).

Below that section, you should let the client know ahead of time when payment is due. Clearly state any late payment penalties you will apply to prevent arguments down the road.

4. Have a Follow-Up Plan Ready to Go

Do you have an automated system in place for those follow-up invoices? How are you keeping track of what has been paid and what is outstanding? As you develop your procedures, you’ll see the importance of having your contacts, contracts, document storage, and invoicing systems together in one program, like Bloom.

Hand-written or manually typed invoices are fine as you get started, but you’ll need to be diligent about remembering to follow up. Neglecting this step could cause you to lose invoices in between the cracks.

As you grow, you’ll want to turn to software that automatically generates invoices. Your system should also add relevant changes for second, third, and final notices.

Ultimately, you’ll be too busy being creative and doing what you love to worry about following up on your invoices.

When your client isn’t paying because of their declining cash flow, they’ll already know what to expect from you. Your invoices clearly stated your expectations and were regularly sent without extra work from you.

The catch here is to combine your personal touch with the professional software and follow-up protocols. Many freelancers find it helpful to reach out to clients with a friendly reminder after the first invoice date passes.

Taking time to make a personal connection may alone solve the problem. You may find that your invoices weren’t forwarded to the right person.

Learn how to stay on top of everything: Your Complete Guide to Freelance Project Management

5. Consider Adjusting Your Payment Policy

Having a set of guidelines and expectations works most of the time, but keeping it set in stone and charging late fees might backfire on you. If you know ahead of time that your client’s revenue is down, you might want to consider adjusting your contract.

Sometimes, flexibility is the key to helping your client in their time of need while still being paid, too.

Think about the type of service this client usually requests from you. How can you adjust your payment policy to benefit you both?

Instead of requesting the funds in one big lump sum, it might be easier for your client to pay in smaller chunks. Talk to them about breaking up the service into milestones if it’s a long-term project.

This way, clients are regularly billed a manageable amount, and you aren’t doing a lot of work for nothing.

6. Make It Easy to Get Paid!

In a brick-and-mortar shop, customers can see on the window what type of credit cards you accept, or if you’re cash only. Smart business owners prominently display this information to avoid issues at checkout, and you should, too.

The more methods of payment you are willing to accept, the wider net of clients you’ll attract.

This smart business strategy deters would-be complainers. If you only take one or two methods of payment, your client can delay their remittance by saying they don’t have access to that form.

Some banks charge a hefty fee to process credit cards, which can hurt small businesses. It’s a juggle to decide whether it’s worth taking credit cards and getting hit with those fees or possibly losing clients because you don’t take cards.

Instead of accruing different costs for every payment you accept, make it easy on yourself. Go digital by using an all-in-one platform where you can accept any online payment method.

7. Invest in a Customer Relationship Management System

A paper trail of your client communications is going to be hard to keep up with. It’s time-consuming, too, which can end up costing you money.

At some point in your business, the smartest move you’ll make will be investing in a customer relationship management system (CRM).

When you’re busy, the little things can be lost in the shuffle, like acknowledging a valued client’s birthday. These little personal touches can inspire loyalty from your customers and encourage word-of-mouth referrals.

Following up is also important in many businesses. With a CRM, you can add notes of when you last spoke with your client and what you said, and set reminders of when to contact them again.

The system should also be able to manage your documents and store your info in one easy place.

As you choose a CRM, don’t go based on your current workload and needs. Look to the future and find one that is flexible enough to meet and exceed your long-term goals.

Many creatives rely on someone else to do the drudgery work of taxes, paperwork, and other business necessities for them. If this is your goal, find a CRM that includes aspects such as:

- An easy-to-use communication portal, like chat messaging

- Pre-made templates for most forms

- A website builder platform

- 24-hour support accessible through different avenues

- Automated contracting and invoicing capabilities

- Scheduling and note-keeping calendars that integrate with other systems

- Document storage with a simple sharing feature

Some of these features might not be important to you currently, but as your business grows, your CRM can grow with you.

Client Invoicing Template: The Anatomy of a Polite But Firm Invoice

While customer service should certainly be a top priority for your business, getting paid should be equally as important.

At the end of the day, everyone wants their clients to be happy and nobody’s happy about bills, right? Even though you’ve agreed to provide a valuable service in exchange for a fee, asking people for money can be uncomfortable. Even when a client is not struggling financially, it can feel a little awkward to send an invoice. As a freelancer, you are probably well aware that relationships with clients can be tough to develop sometimes. It takes a lot of time and effort to build a strong client connection, and the last thing you want to do is be pushy about payment and scare them away.

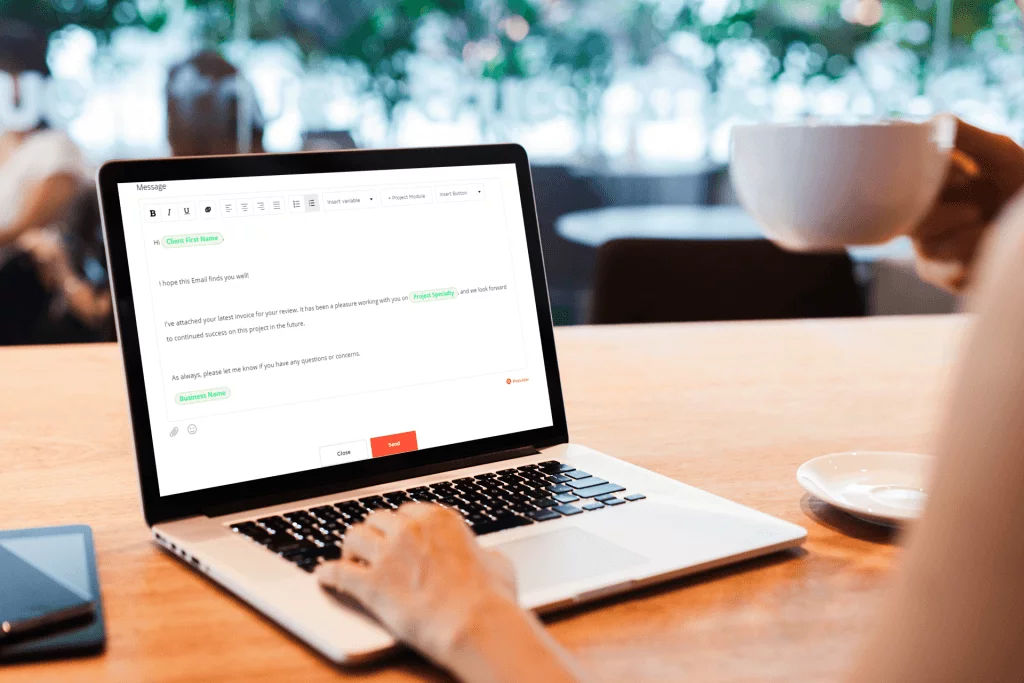

So how do you find balance between maintaining a delicate relationship and the fundamental business function of getting paid? Try this template:

Hi Client First Name,

I hope this email finds you well!

I’ve attached your latest invoice for your review. It has been a pleasure working with you on Project, and we would love to provide Services again in the future.

We understand that times are difficult right now, and we are grateful that you chose to work with us. When it comes to your invoice, there shouldn’t be any surprises but please don’t hesitate to reach out with any questions or concerns.

We hope to work with you again someday soon!

The most powerful thing you can do is let your client know that you understand their circumstances and you’re committed to finding an equitable solution that works for all parties.

Related: Lead Generation for Freelancers: How to Get More Clients

In Short, This is How You’ll Get Paid

If you walk into every client transaction expecting and prepared for obstacles, you’re more likely to get paid instead of jilted.

Plan ahead for processes that will work when you’re so busy doing your creative thing that you don’t have time for the business side.

Find a professional software program that automatically invoices your clients and follows up for you. Be flexible with your payment terms if you know a particular client is having a hard time with revenue.

Open yourself up to accepting multiple forms of payment options, and set long-term goals for your business that a CRM can help you with.

Preparing for problems before they happen is savvy business sense. You can protect your revenue from falling along with your client’s by following these simple professional protocols.

Get organized and keep track of invoicing the easy way: try Bloom for free for 14 days!