If you’re a freelancer, you understand how essential it is to get paid promptly for your services. Sometimes clients are late in paying their invoices, which can potentially strain your cash flow. Digital solutions like Paypal offer a secure and easy-to-use payment system to send and receive money, make online purchases, and transfer money between bank accounts. You can also use it to pay for services on websites that don’t accept traditional methods of payment like credit cards or checks. Paypal charges a 2.9% debit card fee, plus a flat fee of 30 cents if the funds come from the United States. The fee increases to 4.4% plus a flat fee based on the currency for international transactions.

Paypal is one of the most popular online payment processors to receive payments, but there are several great alternatives that offer similar benefits with lower processing fees and faster turnaround time for withdrawn funds. Paypal is only one of the many payment processing systems accessible today and some are designed to be on your paycheck’s side, while others keep a higher percentage of your earnings.

We analyzed and compiled the best PayPal alternatives, finding the best online payment platforms with the most seamless checkout experience. Here are the benefits and drawbacks of each payment processor, as well as processing fees.

1. Bloom

Freelancers and small business owners can receive payment instantly and keep more of their earnings with Bloom. This payment app and software is the all-in-one option that gives business owners and clients the most modern and seamless experience.

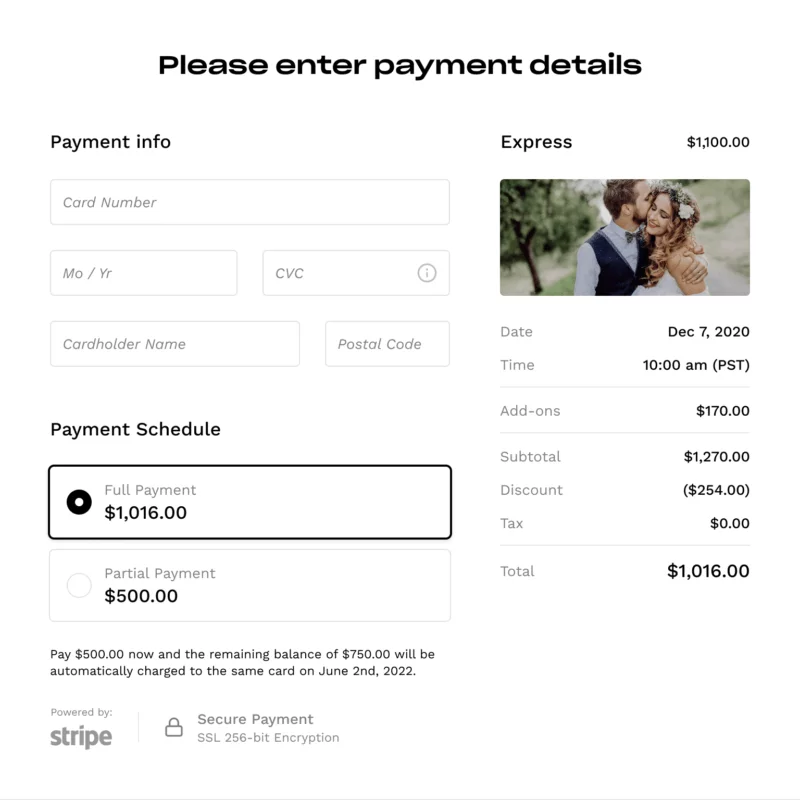

For one, you can create professional invoices with your company logo and branding. When a client receives your branded invoice, they can access their personal portal to review their details and seamlessly pay. This makes it easy for your clients to stay on top of their invoices and payments, and ensures that you get paid on time. Best of all, with Bloom’s automated payment reminders, you’ll never have to chase down a late payment again.

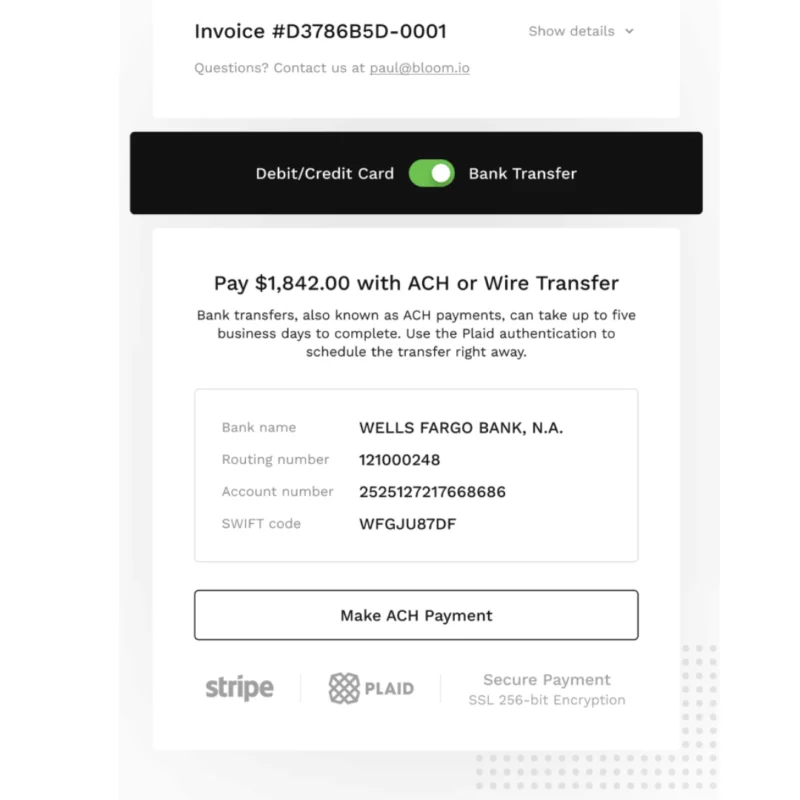

Bloom accepts debit and credit card payments, as well as ACH bank transfer payments online or the app. Bloom doesn’t charge anything for ACH payments, and it offers Stripe and Square payment options. Stripe has the lowest ACH fees compared to the other online payment methods listed, but we’ll get to that next.

The advantages of utilizing the Bloom payment system are:

- No added payment processing fees

- Square, Stripe, and ACH payment integration

- Available in over 25 countries and supports 135+ different currencies

- Feature-rich all-in-one system

- Set retainers

- Auto-charge payments

- Offer tipping and discounts

- Add sales tax

- Partial payments available

- Automatic payment reminders

- Downloadable reports

- Unlimited reports

- Invoice management

Try Bloom to send unlimited invoices and receive payments for free.

2. Stripe

Stripe is a powerhouse of a payment processor. It accepts many payment methods and supports more than 135 currencies. While Paypal has an external link to send to clients that leads them to the Paypal site, Stripe transactions can be embedded on the owner’s site which avoids monthly fees. When it comes to the fee structure, Stripe charges less for credit card processing than Paypal. For online payments, it’s 2.9% plus 30 cents per transaction. For in-person payments, it’s 2.7% plus 5 cents per transaction. International transactions include charges of 1% for international cards, and an additional 1% if currency conversion is needed. The best part of Stripe is the super low ACH charge of 0.8% with a cap of $5.

Let’s take a look at Stripe’s best perks:

- ACH debit and credit transfers and wire transfers

- Streamlined financial reports for accounting

- Scheduled payments

- Multi-currency payout options for global partners

- Types of payment accepted: Credit and debit cards including Visa, Mastercard, American Express, Discover

- Digital wallets including Alipay, Apple Pay, Google Pay, Microsoft Pay, Click to Pay and WeChat Pay

- Buy now, pay later options including Klarna and Afterpay

- Fraud protection

Overall, Stripe is a solid choice if you want a payment process on your side. It’s worth mentioning that Stripe’s Chargeback Protection program will charge a $15 penalty for disputing a charge until the bank decides a verdict.

3. Square

Square is another universal payment processor that offers secure contactless payment. They’re used more in retail and restaurants for in-person transactions. The mobile reader is completely free and connects to your smartphone or tablet to begin swiping in minutes.

Square accepts many forms of payment including Apple Pay, Android Pay, and more. They offer invoicing and easy setup on a Square Reader, via app or computer, or on your website. The standard credit card processing fee is a fixed 2.6% + 10¢ for swiped or inserted chip cards and swiped magstripe cards. For manually keyed-in payments, you will have to pay the 3.5% + 15¢ fee. With a higher processing fee, Square is ideal for smaller transactions, but not if you process larger ones.

Square’s most beneficial features:

- Fixed-rate at 2.6% + $0.10 per swipe

- No monthly or annual fee

- No contract

- User-friendly interface

- Free swipe card reader

- Free POS app

- Can accept offline payments

- Quick deposits within 2 business days

- Secure payment processing

Aside from the need to improve their customer support, particularly with troubleshooting the payment gateway, Square is an ideal PayPal alternative, thanks to its simplicity and security.

4. Quickbooks Payments

With QuickBooks Payments, you can optimize your whole invoicing and payments procedure, making it simpler for company owners to make secure payments. You’ll always be in the know with real-time alerts when customers view or pay invoices. Although invoice customization is limited, many business owners like accountants prefer using this payment software as it integrates with QuickBooks. Just connect your QuickBooks account and start processing payments.

When it comes to transaction fees, you can expect to pay 2.40% plus $0.25 per swipe transaction and 3.40% plus $0.25 per keyed-in card transaction with Intuit’s pay-as-you-go plan (no monthly fee). ACH payments are not charged a per-transaction fee under either plan. In the grand scheme of things, your profits will be affected if most of your clients pay with credit cards. In addition, their two-to three-day turnaround is a little outdated. It’s not terrible; it’s simply not as good as it could be.

Regardless, Intuit is a popular payment provider that offers a variety of features and benefits:

- Flat-rate pricing

- QuickBooks integration

- No monthly minimums

- Email invoices with payment link

- Mobile POS and swiper

- ACH bank transfers

- Mobile App

Quickbook payments is an ideal payment platform if you’re already using the QuickBooks bookkeeping software, otherwise you may want to consider lower processing fees.

5. WePay

WePay is a great choice for marketplace and SaaS businesses that need a reliable payment processing service with low fees. Their customer support may not be the best, but their features and pricing make up for it. WePay allows you to collect payments through your ecommerce site or online business, send invoices, and receive payments securely. For businesses, WePay charges a 2.9% and $0.30 fee per credit card transaction. They also accept ACH payments for a 1% and $0.30 fee per transaction. Overall, the fees are reasonable, and there are no monthly costs or account management fees. The customer care department is only accessible by email.

Review of WePay’s Best Features:

- Apple and Android Pay compatibility

- Direct bank transfers

- Transaction-level reporting

- Mobile point-of-sale

- Sending invoices is free

- No setup fees or monthly fees

As you can see, WePay is designed for large platform operators and does not have dedicated accounts for individual merchants.

6. Zelle

Zelle is a peer-to-peer payment with a lower processing fee compared to Paypal. It’s a simple mobile payment app that allows you to send money from your bank account to anyone you already know and trust. If you’re just getting started as a business owner, your first transactions will be made simple using this convenient option.

Zelle only supports bank transfers, and those already enrolled with them can receive money transfers in minutes. Your clients will be able to send funds using their email or phone number. On the other hand, one of Zelle’s most serious drawbacks is its lack of fraud protection, while other payment platforms have buyer protection.

Zelle charges a 2.5% of the transaction amount compared to Paypal’s 2.9% processing fee and $0.30 per transaction. Zelle restricts its users to sending a maximum of $1,000 every week to $5,000 every month. Every bank has its own limitations, so be sure you’re aware of them.

Here are the main benefits of using Zelle:

- Integrates with banking apps

- Instant payment transactions

- Sending money is easy with recipient’s email or phone number

Zelle is a more secure option for small transactions as you don’t have to share your bank account information with clients. If you are just starting out on your freelance journey, Zelle is a solid option for your first transactions.

7. Google Pay

Google Pay isn’t just a digital wallet that has tap-to-pay functionality on mobile devices; you can also use it for in-store and online payments. Consumers can utilize mobile card payments and digital passkeys to access all of the advantages, including flight reservations, frequent-flyer miles, loyalty points, coupons, and even electronic bills.

If you have a Google account, you are technically signed up for Google Pay and you can send money by email. There are no fees when money is sent via a bank account. However, there will be a 2.9% fee with credit card payments. If you’re an iOS user, you can also access Google Pay through your mobile device.

Overall, this is a reliable online payment system if you’re sending money to Google Pay customers.

Here are some additional features:

- Available in 28 countries

- Integrated with mobile banking apps world-wide

- Advanced security to prevent fraud

- Transfer money to bank account without having to cash out

8. Venmo

Venmo, owned by Paypal, is designed for person-to-person online transactions in the US only. You can quickly transfer money to friends and family or business transactions. It offers credit and debit card payments, and ACH transfers. Keep in mind that Venmo has limits for transactions: $4,999.99 for person-to-person payments and $6,999.99 for payments to authorized businesses. It does not offer buyer protection like Paypal does. If you use the app as a business owner or freelancer, your personal payments will be separate from your business payments. Users who identify themselves as businesses will be charged 1.9% plus a $0.10 transfer fee for any money sent to them. However, there isn’t just one transaction fee involved here. They charge 1.5% per instant transfer from Venmo to a bank account with a 25 cent minimum fee and $15 maximum fee.

Venmo’s best features:

- Quick payments

- Sending money from a bank account or debit card

- A social element to sending and receiving money

Take a look at these Venmo alternatives to further explore similar payment methods with no fees.

9. Payoneer

Payoneer is another popular choice for payments and international transfers. The best part of using this payment solution is that it’s compatible with 150 different currencies via bank transfer. If both parties are using this payment platform, there’s no additional fee for most bank transfers, which is great for e-commerce businesses and other B2B sale transactions.

Payoneer doesn’t have the most seamless checkout since it is not connected to a bank. The customer must initiate or request payment, and funds must be transferred from your Payoneer account to your bank.

Another aspect to consider when using this POS system is the high 3% fee for credit card payments for customers without a Payoneer account. For a local bank transfer, you’ll pay a 2% fee if your funds are in a different currency than your bank uses. For depositing funds in the same currency, you will incur a $1.50 fee. Transferring balances between different currencies within your Payoneer account will incur a 0.5% fee.

Besides the pricier model for transactions, this may be your ideal POS system for international money transfers. If you need to accept credit card payments online, you’ll be better off with another alternative.

The main benefits of using Payoneer are:

- Available in 200 countries with 150 local currencies

- Free payments between Payoneer accounts

- Invoices and payment requests from individual clients

- Customer support includes email, live chat, and phone support

10. Wise

Wise, the international payment solution for cheap, is an online payment service for small businesses. It claims to have a fair exchange rate and no hidden fees. You can hold and convert money in 53 currencies, and use your multi-currency account to send money to 80 countries.

Here are some notable features:

- Low conversion fees for currencies

- Direct debits can be set in Euros, British pounds, Australian dollars, and U.S. dollars

- No subscription or monthly fees

- Batch payments

- Spend funds in any currency with Wise card

Your clients must have a bank account to receive payment. For sending money, fees vary by currency, and ATM withdrawals over $100/month are charged 2% per transaction.

So, if you’re looking for a way to take back control of your business and ensure that your transactions are secure with low fees, there are numerous options available. Payment processors are not created with the same features for a reason. As you can see, some are tailored for international transactions and B2B sales, while others are intended for freelancers and small businesses.

Don’t know where to start? Try creating and sending an invoice through Bloom for free. Since it’s already integrated with Square and Stripe, you’ll experience all the benefits of those payment platforms for free. You can also accept an ACH payment through Bloom and keep the most of your earnings.